Our portfolio reflects our diversity of approach, experience and track record.

Savo venture portfolio

Businesses we own, operate and have launched.

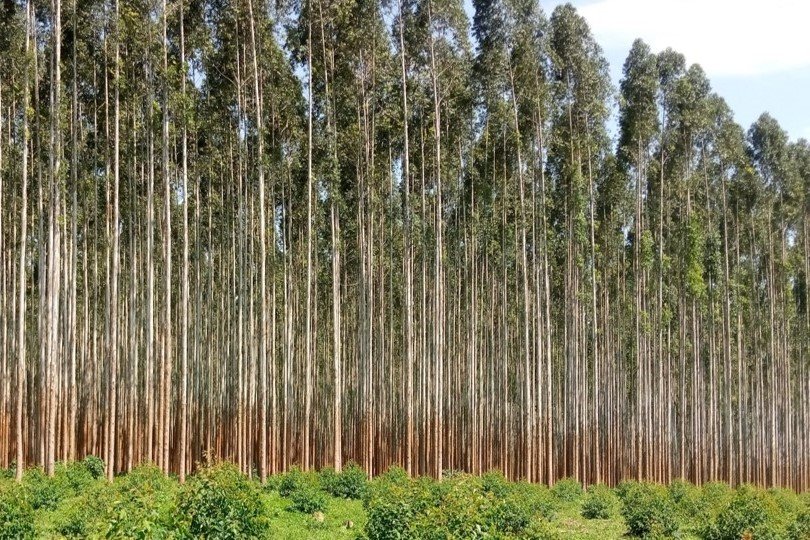

A smallholder agricultural commodity value chain developer and trader, working with a network of over 40,000 farmers across ~8,000 hectares to grow and trade timber and perennial tree crops, improving rural livelihoods while restoring degraded land and supporting climate resilience.

business building track record

Entrepreneurs and organisations we’ve supported to turn ideas into operational businesses.

Secured USD 1.3 million in blended finance for a regenerative agroforestry business in Uganda by developing a business plan and financial model, enhancing investment readiness and securing a long-term offtake agreement with an international cosmetics company.

Secured a USD 3 million development budget for a platform transforming Ethiopia’s wild forest coffee value chain by developing the business plan, financial model and implementation roadmap.

Developed a scalable business model for a regional aquaculture initiative in East Africa by structuring the operational framework, defining the route-to-market strategy, building a financial model and generating a shortlist of qualified operators to support execution.

Secured USD 35 million in tenant revenue and developed the expansion strategy for Nigeria’s largest privately owned freezone by building the business model, managing technical development and securing a pipeline of non-oil tenants to support the zone’s transition to net zero.

Facilitated a USD 420,000 tenancy agreement for a logistics and industrial hub in Kenya by acting as agent and introducing a baked goods business as a strategic tenant.

Managed a USD 130,000 budget to support a sustainable vanilla enterprise in Madagascar and led the design of a traceability system to strengthen monitoring and enhance investor and offtaker confidence.

Secured USD 8 million investor term sheet and USD 11 million in annual offtake commitments for a Ugandan timber aggregation and processing business by leading strategy, structuring, governance, recruitment and full investment process through an USD 850,000 project management office.

Delivered high-level project development support for a USD 108 million industrial park by designing the commercial strategy, articulating the business model and target sectors, and overseeing the development of the concept masterplan.

Developed the commercial strategy and business plan for a clean energy platform in Nigeria by conducting sector mapping, gap analysis and business model development to support market entry into electric vehicles and clean cookstoves.

Advised the government on attracting private investment into public commercial forestry plantations in Kenya by producing a sector report, identifying priority interventions and developing a framework to guide investment-focused decision-making.

Developed a landscape-wide financing mechanism to support agroforestry adoption for smallholder cocoa producers in Côte d’Ivoire by designing and market testing the facility, developing the business plan and producing a knowledge product to guide future implementation.

Developed a project teaser for a mangrove carbon project covering 14,000+ hectares on the Kenyan coast by reviewing the financial model and supporting early-stage positioning ahead of government approval.

Advanced the development of a nature-based carbon project in southwest Nigeria by managing prefeasibility assessments, securing government approvals and coordinating stakeholders to prepare for carbon credit issuance and investment mobilisation.

Developed market projections for Uganda’s timber sector under multiple export scenarios for a trade policy dialogue by conducting top-down and bottom-up market sizing and modelling export restriction impacts.

Secured £180,000 in returnable grant funding and matched capital for an NTFP market access project in Cameroon by structuring the business, developing the commercial model and business plan and assessing project viability for execution.

Delivered high-quality commercial design and concept masterplan for a 75-hectare industrial park in Ethiopia by articulating the business model, value proposition and target sectors and overseeing technical development.

Enabled Nigeria’s first nature-based voluntary carbon project by securing USD 250,000 in grant funding, leading government negotiations and coordinating technical and investor workstreams.

Managed a USD 600,000 budget to support a smallholder forestry and timber business in Kenya to develop an FSC certification action plan, build carbon market readiness and prepare for future investment structuring and benefit sharing.

Secured a USD 1 million development budget for a 400-hectare sustainable industrial park in Kenya and led sector prioritisation, preparation of pitch materials and engagement of prospective tenants and strategic partners.

Secured a USD 1.3 million budget to support a diversified agroforestry social enterprise in Madagascar and led the development of the business plan and financial model, enhancing investment readiness through a partnership-led approach.

Managed a USD 1 million budget for a 150-hectare sustainable industrial park in Kenya and led commercial strategy, technical design and investor mobilisation, securing a USD 5 million equity term sheet, land contribution worth USD 10 million and tenant MOUs covering 30% of park capacity.

Running a USD 1 million project development fundraise for an elephant sanctuary and ecotourism venture in Nigeria by supporting business model development and preparing for pre-development financing.

Developed the business and financial model for a USD 900 million waterfront redevelopment and residential island project in Lagos by shaping the concept, advising on concession agreements and supporting the preparation of a government concession proposal.

Secured USD 3.2 million investment and sold-out Phase 1 for a 750-acre sustainable ecovillage in Kenya by developing the strategy, business plan and financial model, overseeing technical design and operational setup, and leading commercial execution.

Developed an implementation plan for a new commercial conservation vehicle in Kenya by defining the strategy, service offering, governance structure, operating model, financial plan and risk assessment.

Developed the vision and commercial strategy for an 88,000-acre conservation project in Kenya by developing a high-level concept masterplan, creating investor materials for a residential conservation estate and engaging prospective buyers and partners.

Managed a USD 750,000 budget to support a sustainable commodity enterprise in Uganda by refining its agroforestry model, developing governance and timber strategies and delivering investment readiness and community engagement plans.

Strengthened tenant acquisition for a 4,700-hectare industrial hub in Angola by professionalising the sales team, developing SOPs and marketing materials, and coordinating trade roadshows to the USA, Middle East and Asia.

Investment banking track record

Transactions we’ve closed, investment pipelines we’ve developed and funds we’ve advised.

Climate transformation advisor for a USD 250 million pan-African infrastructure fund, assessing sector-level climate potential, screening portfolio opportunities and supporting detailed due diligence on high-impact investments.

Designed a scalable USD 2.5 million lending facility (scaling to USD 10 million) for a sustainable housing company in Uganda by securing investor buy-in, providing structuring support and overseeing legal and regulatory assessments.

Developed a pipeline of 80 green investment opportunities worth USD 1.4 billion for a UK development initiative in Sudan by aligning on mandate, sourcing and assessing opportunities and designing investment structures and materials for 9 high-quality deals.

Structuring a USD 30 million grain milling transaction in Uganda for a regional conglomerate by supporting investment readiness, engaging potential financiers and securing expressions of interest for a USD 19 million capital raise.

Structured a USD 3 million capital raise for a nutritional bar manufacturing facility in Egypt for a regional nutrition supplier by designing the transaction, engaging investors and securing a grant commitment prior to the project being paused due to external factors.

Identified a USD 50 million pipeline of private sector relocation opportunities in response to the Sudanese civil war for a UK development initiative by conducting conflict risk assessments, enhanced due diligence and transaction structuring, resulting in one investor term sheet and a secured USD 3 million grant.

Supported the launch of a USD 50m distributed solar investment fund in Nigeria for a regional private equity firm by designing a first-of-its-kind pension-eligible fund structure allowing for local currency capital participation and identifying a USD 250m pipeline of opportunities.

Advised a USD 3 million seed round for a modular biochar business operating in Kenya by engaging over 50 investors and advising on transaction structure.

Structured an USD 8 million capital raise for a new medical manufacturing facility in Sudan for a regional conglomerate by designing the transaction, identifying and engaging investors, and leading negotiations.

Identified and engaged over 30 potential real estate partners for a 750-acre sustainable eco-village in Kenya by reviewing the financial model, assessing key risks and advising on fundraising and structuring options.

Secured a USD 5 million debt refinance for a Nigerian logistics port development by building the business and financial model and market testing the opportunity with investors and strategic partners.

Secured USD 21 million investment for a 12MW power plant in Nigeria by providing commercial, transaction advisory and project management support.

Prioritised investable restoration opportunities across three African landscapes for a regional USD 50 million investment and technical assistance facility by mapping product-market fit and identifying high-potential concepts to guide capital allocation and partner engagement.

Structured a USD 3.5 million blended finance framework agreement for a commercial forestry investor and development partner by designing, structuring and overseeing execution of matched funding for impact-focused and ESG-aligned activities.

Secured USD 4 million in funding for a solar developer powering two mines in Sudan by structuring the investment, building the financial model, negotiating terms and helping deliver the country’s first private solar power purchase agreement.

Identifying and prioritising agri-allied and agri-processing investment opportunities across East Africa for a UAE-based family office by aligning on mandate, sourcing a long list of businesses and shortlisting high-potential opportunities for capital deployment of USD 500,000 to USD 3 million per deal.

Catalysed USD 30 million in investment for agriculture and forestry businesses in Africa under a UK-funded programme by delivering technical assistance to enhance investment readiness and training regional investment officers across West, Central and East Africa.

Built a USD 600 million pipeline of sustainable industrial zone opportunities across Kenya, Ethiopia and Nigeria for a global climate initiative and supported five priority projects with business model design, technical master planning and investor engagement.

Mobilising investor interest for a USD 5m debt raise to finance a new beverage production facility in Port Sudan for a regional conglomerate by serving as transaction advisor, leading investor engagement and managing negotiations.

Designed and structured a USD 10-20 million technical assistance and investment facility for a commercial forestry investor and development partner by developing the facility concept and preparing investor-facing materials to support mobilisation.

Advised seed USD 300k round for a fast-growing Kenyan craft beer company by leading investor outreach to over 50 investors and advising on transaction structuring.

Secured a term sheet for a USD 1 million working capital facility to finance 500,000 solar home systems for humanitarian distribution in Sudan by structuring the transaction, engaging investors and leading negotiations.

Leading a debt and equity capital raise for an USD 2.5 million eco-tourism hospitality business in Lamu by preparing investor materials, coordinating high-level due diligence and engaging potential investors including banks and high-net-worth individuals.